All information presented on this page, including links to plan documents and descriptions, is specific to the plan year of July 1, 2024 - June 30, 2025.

A flexible spending account program provides an opportunity to reduce your Federal and Social Security taxable income, and in some instances state taxes, by funding an account or accounts on a pretax basis. You may obtain reimbursement by submitting documentation of qualified out-of-pocket expenses relating to your account(s). Note that some FSA Account maximums are total household IRS maximums, whereas others are individual IRS maximums. Please see the limits for each account on their respective pages below.

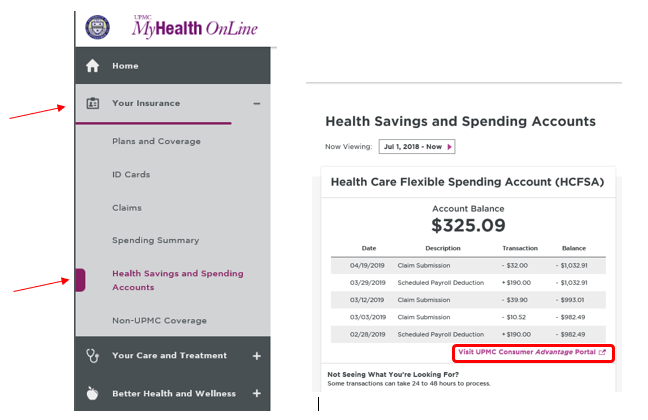

Follow these instructions to submit a claim for reimbursement. Do not discard your Flexible Spending Visa card at the end of the plan year. Cards are not reprinted annually.

Flexible Spending Account Types

- Health Care

- Dependent Care

- Qualified Commuter Expense

- Parking or Mass Transit

Flexible spending accounts are intended to be used for predictable expenses only. Please review the plan details of each flexible spending account prior to enrolling, to determine if a flexible spending account is right for you. You may learn more about the flexible spending accounts in greater detail, including eligible expenses, claim submission deadlines, and claim submission procedures, by calling UPMC Health Plan at 1-888-499-6885.

Note: Going on an unpaid leave terminates your eligibility for any Flexible Spending Account (FSA) program as the deductions must be taken from your paycheck pre-tax. All FSAs will be waived in accordance with the start of your leave. You may re-enroll during the next open enrollment period following your return from an unpaid leave.

Additional Resources

- Flexible Spending Accounts Summary (July 1, 2024 - June 30, 2025) Faculty and Staff

- Flexible Spending Accounts Member Guide

- Learn more about FSA, Health Incentive Reward Dollars, and Wellness for Life