The Accelerated Option is available to fully vested participants between the ages of 52 and 65. To receive the Accelerated Option, you must contribute at least 8% of your base salary to the Retirement Savings Plan. If you meet these criteria and elect the Accelerated Option, the University increases its matching contribution from 12% to 14.5% of your base salary. The University’s matching contributions will generally increase the month following the date in which you make your Accelerated Option election.

To receive the increased matching contribution, you must actively elect the Accelerated Option.

This increase is effective for up to 120 months (10 years) from when you elect it or once you reach age 65, whichever occurs first. When the Accelerated Option period ends, you may continue to make contributions to the Retirement Savings Plan and to the 403(b) supplemental plan. After your period of participation in the accelerated option ends, you are no longer eligible for any match under the 401(a) Plan.

How do you elect the Accelerated Option?

To elect the Accelerated Option, follow the steps below:

1. Login to my.pitt.edu using your University username and password

2. Search for "Retirement Savings Plan Access"

3. Select "Manage My Retirement Account" box

4. This will take you outside of the University systems and you will then be logged into the TIAA system to manage your account(s).

5. To the right of the TIAA logo, please select Accounts.

6. Select the Manage Contributions button.

To change your contributions and/or elect the Accelerated Option, select on the Manage Contributions button.

7. Your current accounts will then be listed, please select Manage Contributions again.

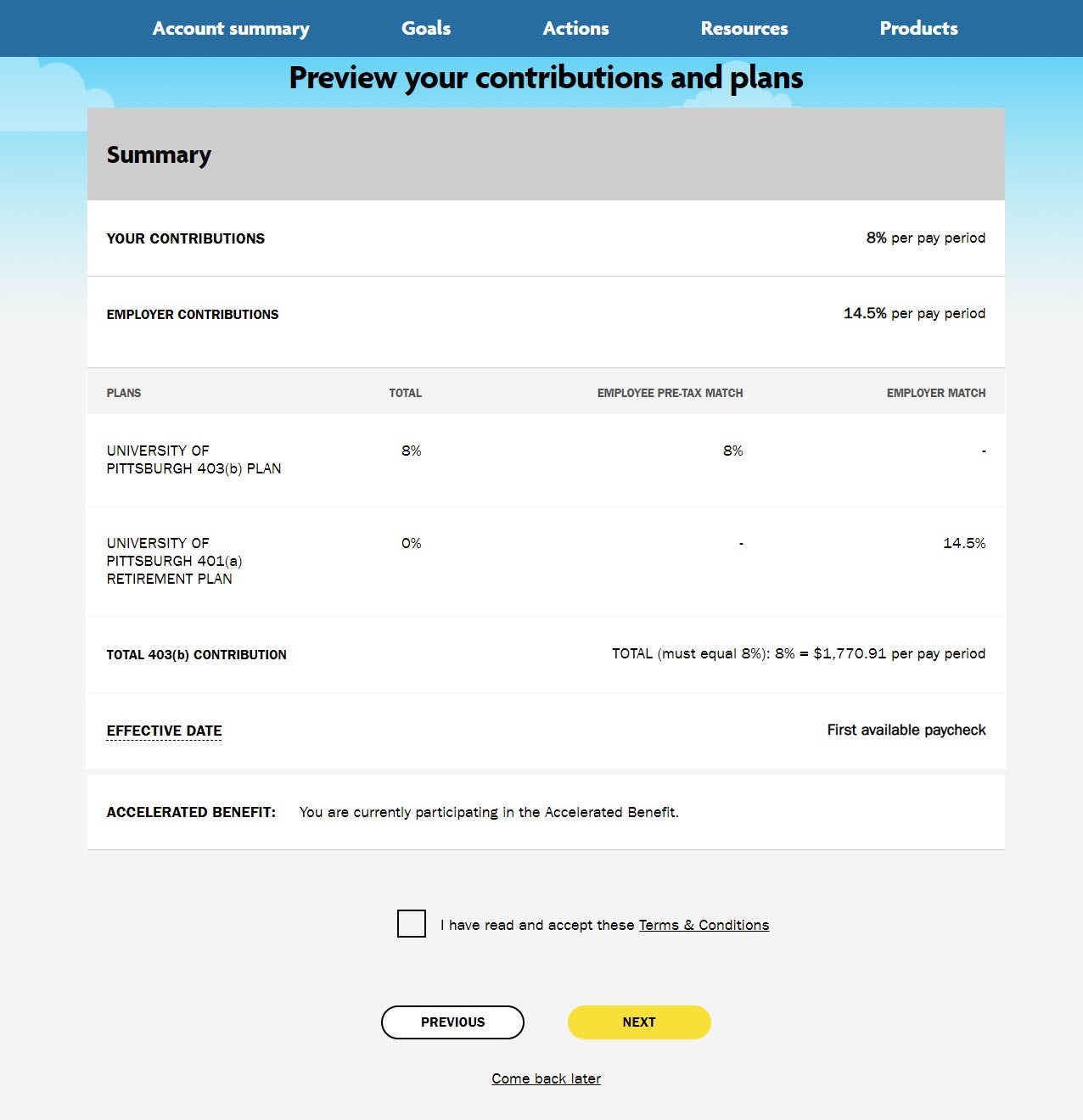

8. You will then see a summary of your current elections and the plans you are eligible for. Please select Manage Contributions again.

9. You must indicate an effective date of the change.

a) Select the Payroll Schedules link to better understand when you will see the change reflected in your pay, future-dated effective dates, or if you are on a biweekly pay schedule

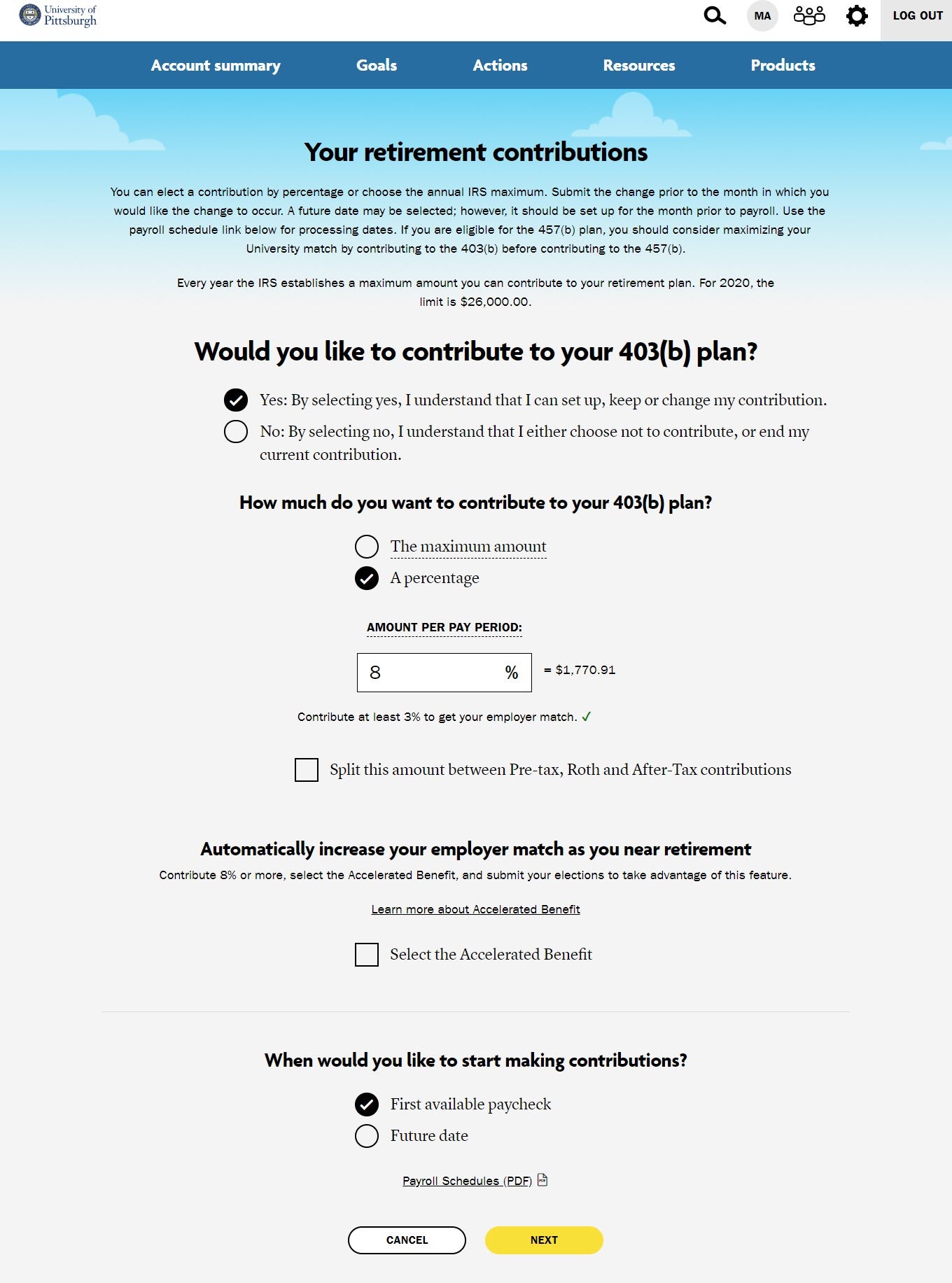

10. Enter the percentage of each paycheck you wish to contribute or select the maximum contribution.

a) Please contact your financial advisor to better understand if Pre-Tax, Roth or After Tax is best for your financial goals.

b) If you do not indicate otherwise, you will be defaulted to Pre-Tax only.

11. If you are eligible for the Accelerated Option, you will have the option to check a box to Select the Accelerated Option. You can enter in a percentage of each paycheck you want to contribute or select the maximum amount allowable under IRS regulations.

12. Once you are done, select the Continue button.

13. You will be asked if you would like to contribute to the 457(b) plan, if you are eligible for it.

a) If you would like to contribute to the 457(b) plan, choose "yes" and continue to make your election.

b) If you do not wish to contribute to the 457(b) plan, choose "no" and continue to make your election.

14. Once complete, you should receive a confirmation page. Please print or save that page for your records.